Financial Issues as a Mental Health Crisis

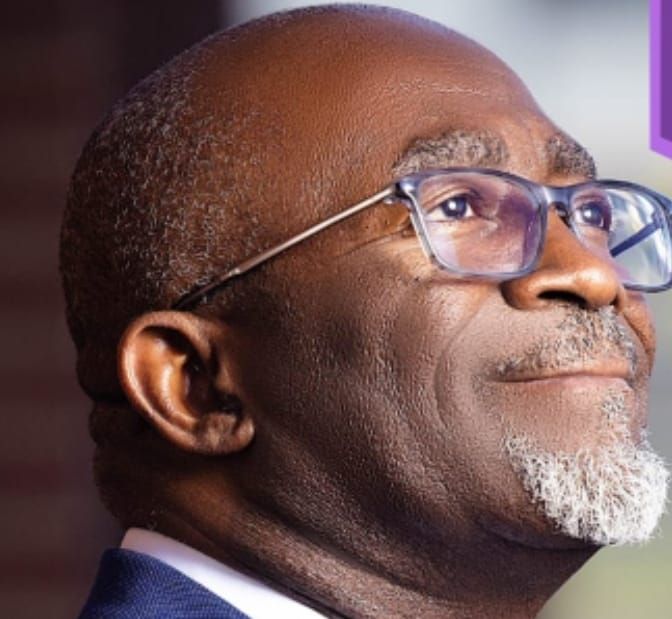

By Dr. David Rex Orgen, Best-Selling Author of Dealing with ADHD and Mental Health Expert

In today’s fast-paced world, financial challenges have become a significant source of stress, anxiety, and even long-term mental health crises. The pressure to meet financial obligations, provide for families, and maintain stability often leads to overwhelming emotional strain, affecting individuals and communities alike.

The Link Between Financial Struggles and Mental Health

Financial stress is more than just an economic issue; it directly impacts psychological well-being. People facing severe financial hardship often experience:

Chronic Stress and Anxiety: The uncertainty of managing debts, bills, and basic needs can create persistent worry and tension.

Depression: Feelings of hopelessness and failure can develop when financial difficulties persist, leading to emotional numbness and sadness.

Low Self-Esteem: Financial struggles can impact self-worth, especially when societal success is often linked to material wealth.

Strained Relationships: Financial stress can cause conflicts in families, marriages, and friendships, further deepening emotional distress.

The Ripple Effect of Financial Instability

Financial hardship doesn’t just affect the individual—it creates a ripple effect throughout entire communities. Key consequences include:

- Family Breakdown: Unresolved financial issues often lead to relationship strain, contributing to divorce and family separation.

- Workplace Productivity: Financial stress affects focus and decision-making, reducing work efficiency and job performance.

- Physical Health Decline: The emotional burden of financial stress can lead to physical health issues such as hypertension, heart disease, and weakened immunity.

- Social Isolation: Individuals struggling financially may avoid social interactions due to embarrassment or feelings of inadequacy.

Financial Stress and ADHD

As an advocate for mental health and author of Dealing with ADHD, I’ve observed how financial challenges disproportionately affect individuals with ADHD and other mental health conditions. The impulsivity, disorganization, and difficulty with planning often associated with ADHD can create barriers to financial stability, making it essential to address both the mental health and practical aspects of financial well-being.

Breaking the Cycle of Financial Stress and Mental Health Struggles

Addressing financial issues as a mental health crisis requires a compassionate, multi-faceted approach:

- Financial Literacy Education: Providing education on budgeting, saving, and managing debt can empower individuals to take control of their finances.

- Mental Health Support: Access to counseling, support groups, and professional therapy can help individuals process financial stress healthily.

- Community Resources: Faith-based organizations, non-profits, and mental health institutions can offer financial assistance, workshops, and support networks.

- Faith and Encouragement: As a pastor, I believe spiritual support plays a key role in healing. Scriptures like Philippians 4:19 remind us of God’s provision even in challenging times.

A Call for Collective Action

Financial struggles should never be faced in isolation. By acknowledging the connection between financial issues and mental health, we can create a society where support, empathy, and education empower individuals to overcome challenges. Together, we can build stronger, healthier communities where both financial wellness and emotional well-being thrive.

Image Credit: Freepik

One thought on “Financial Issues as a Mental Health Crisis”

Add a Comment Cancel reply

Recent Posts

When Cravings Speak Louder Than Words

Degrees Without Doors

Becoming the First Was Never About Recognition It Was About Assignment

Tags

+1 (614) 753-3925

info@inspiremindglobal.com

Hmm this is a very real issue.

Especially here in Ghana